Quarter 4 2023 found the SW Montana real estate market in a continued ‘leveling’ trend. The market felt as though it were stagnating at times – however, inventory remains scarce and while buyers are moving slower to offer – there has been a recent uptick in multiple offer situations. Competition still exists for quality, well priced listings. Interest rates continue to influence the market overall as financed primary and investment buyers await the best time to move forward with a purchase – rates have come down significantly in recent weeks off of yearly highs and it has sparked more market activity. Cash buyers continue to constitute a good segment of the market – and luxury homes continue to pend and close at a faster rate than pre-pandemic levels. Inventory is slowly growing.

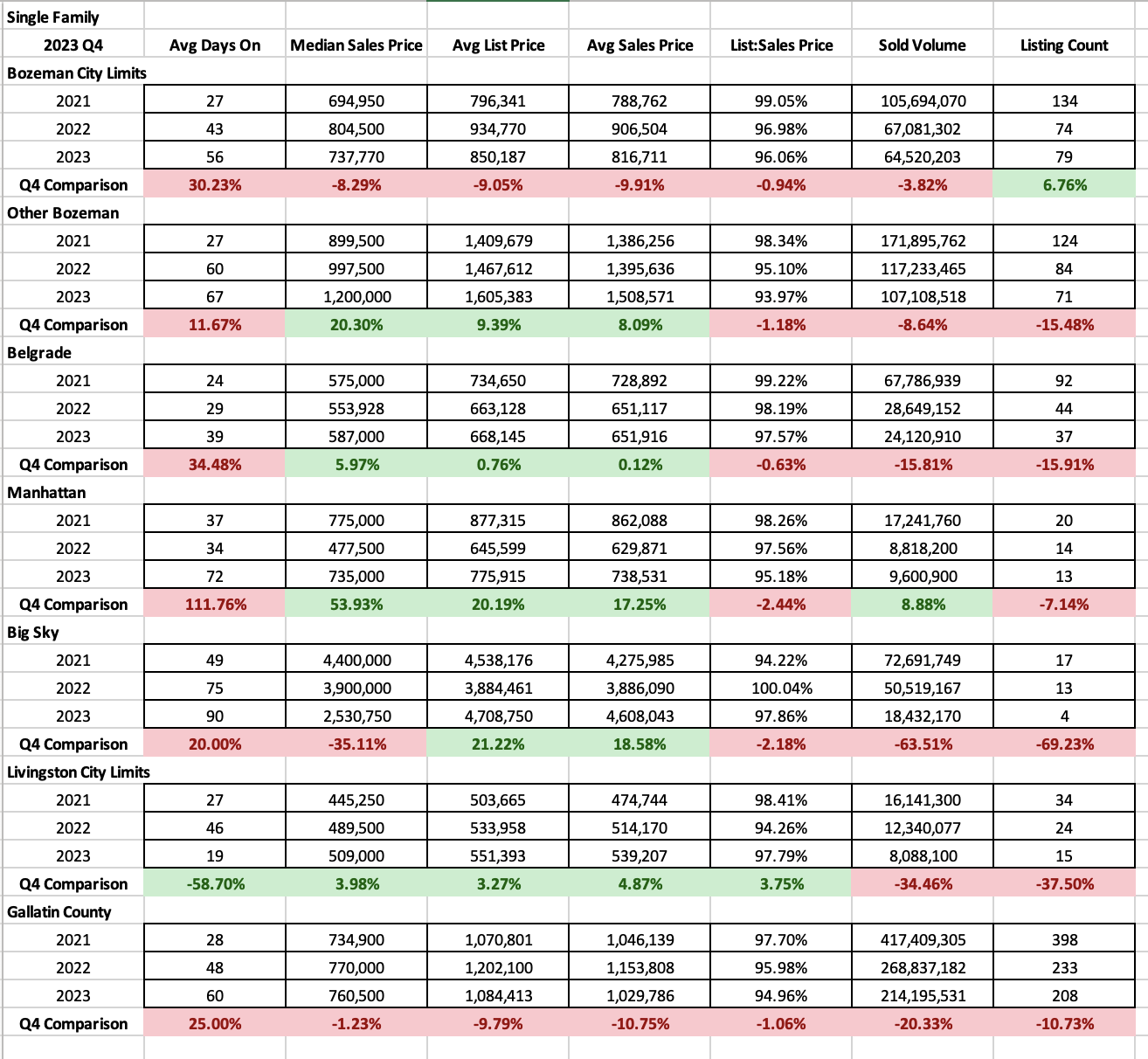

Single Family Homes

Median sales price trends for Single Family homes are a bit scattered area by area – City of Bozeman saw an 8% decline in Q4 2023 over Q4 2022 ($737K) and Big Sky saw a decline of 35% in Q4 2023 over Q4 2022 ($2.5M) though this is highly influenced by lack of properties closing (down 60%). Greater Bozeman area saw an increase in median sales price by 20% ($1.2M), Belgrade was up 6% ($587K), Livingston was up 4% ($509K) and Manhattan was up 53% ($735K) though 2022’s stat median sales was a bit of an anomaly. Prices have not budged much if at all off 2021 peak pricing and in many cases the prices have grown significantly.

Number of properties sold has decreased yet again in all areas with the exception of City of Bozeman which stayed steadier. Volume of sales is some of the lowest we’ve recorded in all areas tracked – well below pre-pandemic levels. Days on market have climbed in all areas except for Livingston. This is in line with a growing inventory of properties that overshot list price that are experiencing price reductions to attract buyers – fueled by a combination of interest rates/overpricing/buyers being pickier. Average days are ranging from around 3+/- months in Belgrade, Livingston, Manhattan and City of Bozeman to 4.5 months in greater Bozeman to closer to 17 months in Big Sky. Of note, there significantly less inventory available on the market in all areas except for Big Sky an City of Bozeman than during Q4 2022 – though properties are siting longer.

List to sales price ratios indicate that buyers continue to discount properties off list price – with 2.5-4% reductions on average in City of Bozeman, Belgrade, Manhattan, Big Sky and Livingston and closer to 7% in greater Bozeman. These ratios are indicative of a balanced to buyer tilted market.

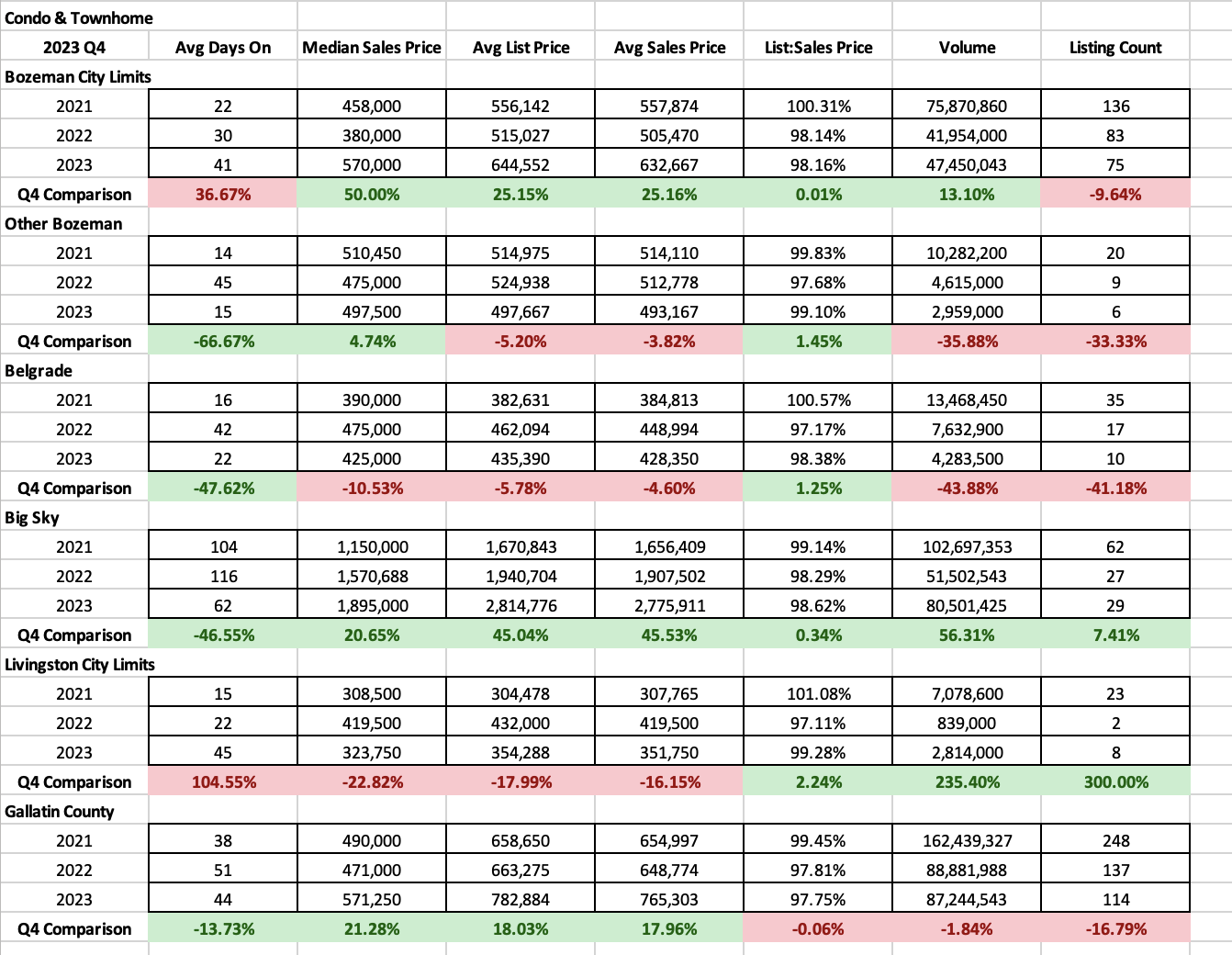

Condo/Townhomes

Condo and townhome median sales prices in Q4 2024 saw a marked increase in City of Bozeman (up 50% to $570K), Greater Bozeman outside city limits (up 5% to $497,500), and Big Sky (up 20% to $1.895M). Belgrade was down (down 10% to $425K) as was Livingston (down 22% to $323K). Belgrade and Livingston saw the greatest recent new construction input into this segment of the market – Big Sky closings were influenced by new construction that pended up to a year longer prior.

Number of closed properties were up in Livingston (300%) and Big Sky (8%) and down in all other areas: Bozeman (10%), Greater Bozeman (33%) and Belgrade (42%). Days on market were up in City of Bozeman and Livingston (to just over a month) and down significantly in all other areas. Big Sky’s absorption rate is 12 months, Greater Bozeman is 16 months, Belgrade is at 9 months, Bozeman is at 4 months, Livingston is at 2.5 months.

List to sales price ratios show a much tighter, balanced marked with less than 1% discounting to about 2% discounting on average across all areas. Less discounting took place in almost all areas than in Q4 2022.

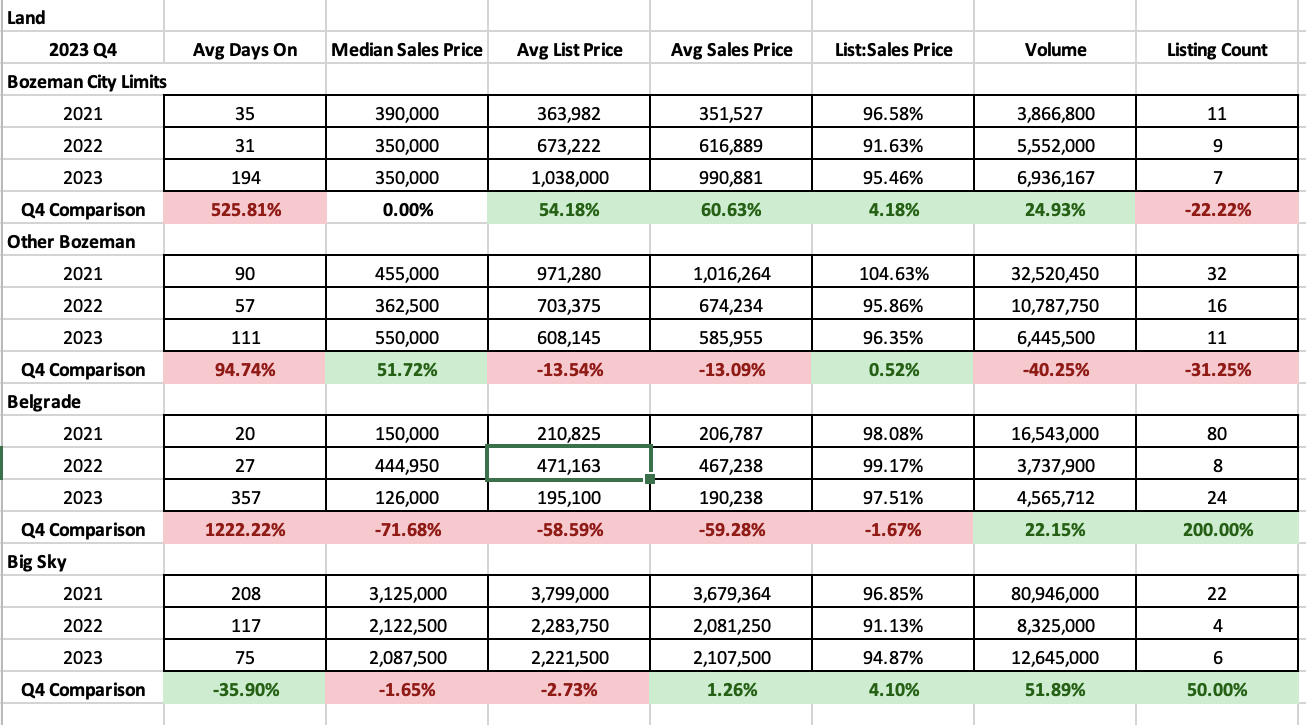

Land

Land continued to be relatively strong overall in Q4 2023 which may come as a surprise to some. Median sales prices in City of Bozeman are flat and steady at $350K. Greater Bozeman saw an uptick of $50% to $550K. Belgrade had a bit of an anomaly for pricing comparison in 2022 but remains down over 2021 by 16% ($126K). Big Sky was relatively flat ($2.1M).

Number of closed properties were up in Belgrade (200%) and Big Sky (50%) and down in Bozeman City limits (20%) and Greater Bozeman (31%). Days on market were up significantly in Bozeman City Limits to 194, Greater Bozeman to 111, Belgrade to 357 but notably down in Big Sky to 75. Absorption rate for City of Bozeman stands at 3 years, Greater Bozeman stands at 6/7 years, Belgrade at 3 months, and 2 years for Big Sky.

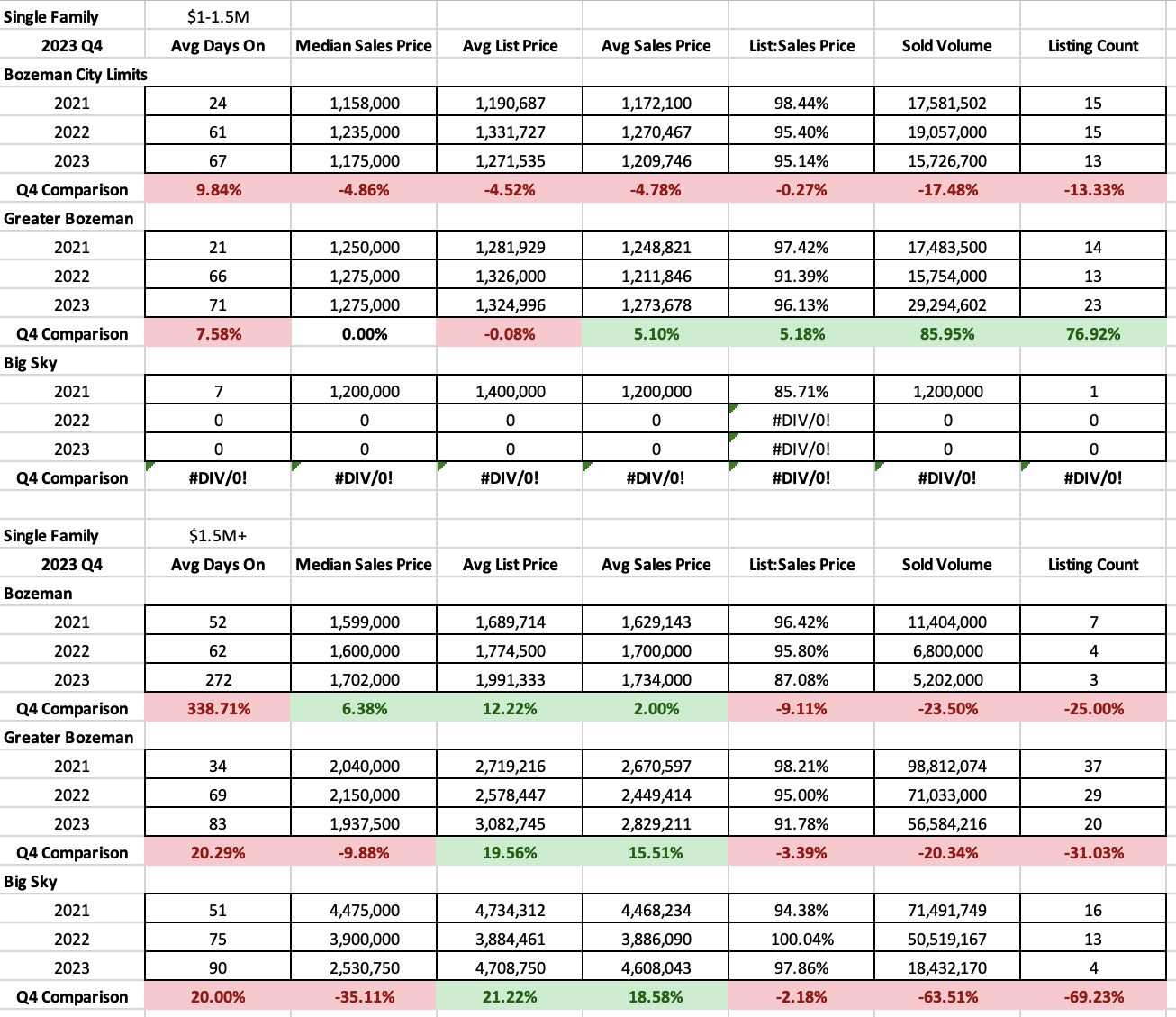

Luxury and High-End Single Family Homes

High end single family homes, those listed between $1M-$1.5M, saw a similar number of sales in Bozeman City Limits in Q4 2023 as Q4 2022 and a significant uptick in Greater Bozeman. Big Sky continues to have no single home inventory in this price bracket. Days on market were up to just over 2 months in both City of Bozeman and Greater Bozeman. And list to sales price ratios show 4-5% discounting by buyers on average – a sign of a stable market.

Luxury homes, those listed above $1.5M, saw a decrease in sales all areas tracked – City of Bozeman was about flat. Greater Bozeman saw a 30% decrease and Big Sky saw a 70% decrease. Days on market were up to 3 months in Greater Bozeman and Big Sky and skyrocketed to 272 days (due to only three sales) in City of Bozeman. List to sales price ratios show heavy discounting in City of Bozeman and Greater Bozeman – close to 10-13% on average. And only 2% discounting on average in Big Sky – a function of the new construction nature of many of the sales in the Big Sky market currently.

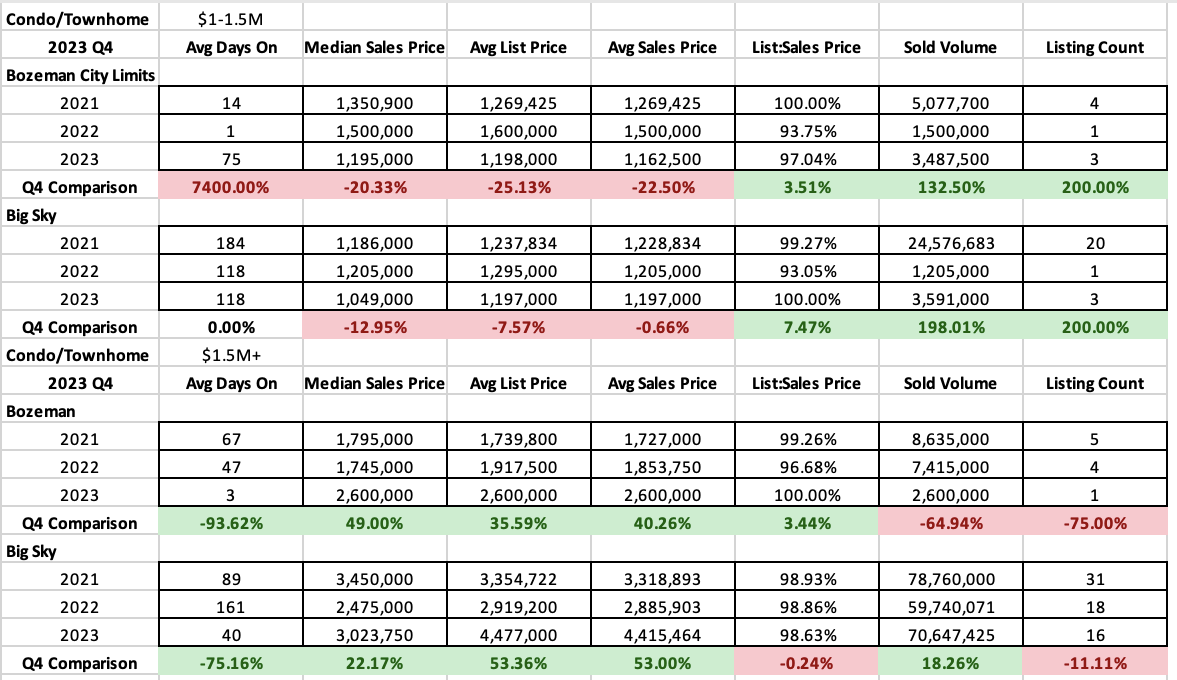

Luxury and High-End Condo/Townhomes

High end condos and townhomes, those listed between $1M-$1.5M, saw upticks in both City of Bozeman and Big Sky for number of units sold. Days on market were up in City of Bozeman to about 2.5 months and steady in Big Sky year over year. List to sales price ratios show very little discounting in City of Bozeman and no discounting in Big Sky.

Luxury condos and townhomes, those listed above $1.5M, saw a significant decrease in City of Bozeman (down to 1 unit sold that sold with no discounting in 3 days). Big Sky was steady for sales, helped by new construction in the pipeline, with very little discounting off list price (1.5% on average) – days on market were just over 1 month in Big Sky . There will be upcoming sales closing in 2024 that have pended in 2022/2023 for this segment in Bozeman.