For a graphical chart version of this information, please visit our Market Stats page.

Q4 2020 Y/Y/Y Analysis

Single Family

Single family home sales accelerated throughout our area in 2020 – fueled by the Covid-19 pandemic and people moving from more populated areas and areas affected by fire and civil unrest.

The theme for the year starting June 1st, when the visitor quarantine was lifted, was lack of inventory. Interestingly this was one of the highest sold inventory years on record in most areas – there were even more buyers than previous years which put more strain on existing and new inventory.

Sold listing counts for Q4 year over year were up significantly in Manhattan, Big Sky, and Greater Bozeman – properties with land were in very high demand. Number of single-family homes sold was up 487% in Big Sky, 666% in Manhattan and 66% in greater Bozeman. Sold listings were up 20% in City of Bozeman. Sold listings were up only 2% in Belgrade and went down 20% in Livingston due to lack of inventory available.

Days on market reduced significantly in almost all areas. Properties that sat on the market for longer periods of time that were finally sold this year have influenced some of the stats.

Median single-family sales price jumped in all areas – significantly in some. Median sales price climbed 32% year over year in City of Bozeman ($600,750), 35% in greater Bozeman area (765,000), 14% in Manhattan ($595,000), 9% in Belgrade ($401,150), 36% in Big Sky ($2.4M), 24% in Livingston ($367,000).

List to sales price ratios narrowed significantly in all areas. List to sales price ratio illustrates how much buyers are discounting off of list price on average. City of Bozeman and Manhattan had less than 1% discounting on average. Belgrade and Livingston had less than 2% discounting. And Big Sky and greater Bozeman had less than 2.5% discounting of list price on average.

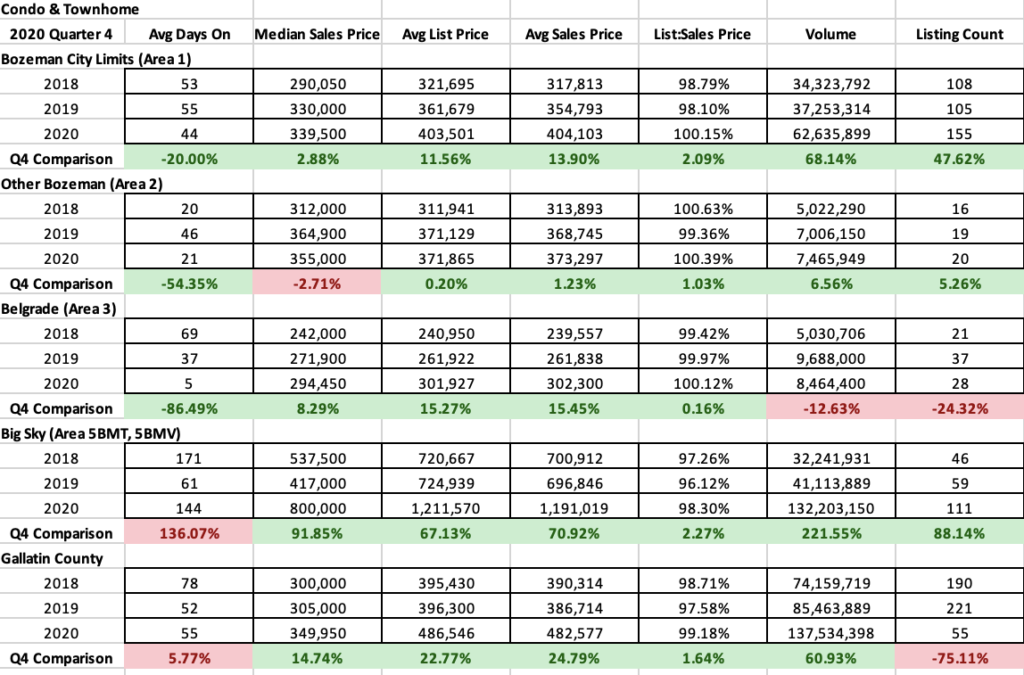

Condos & Townhomes

Condos and townhomes during Q4 2020 in the Bozeman, greater Bozeman, Big Sky and Belgrade areas had another banner year. Median sales price was up in all areas except greater Bozeman. Big Sky had a 91% price hike as luxury new construction properties proliferated the market. City of Bozeman increased 3%. Belgrade increased 8%. Number of listings sold shot up 47% in City of Bozeman and 88% Big Sky due to new construction product brought to market. List to sales price ratios narrowed in all areas – with all areas but Big Sky logging over 100% ratios. Meaning buyers on average were paying above sales price for properties in Bozeman, greater Bozeman and Belgrade. A function of commonplace multiple offers.

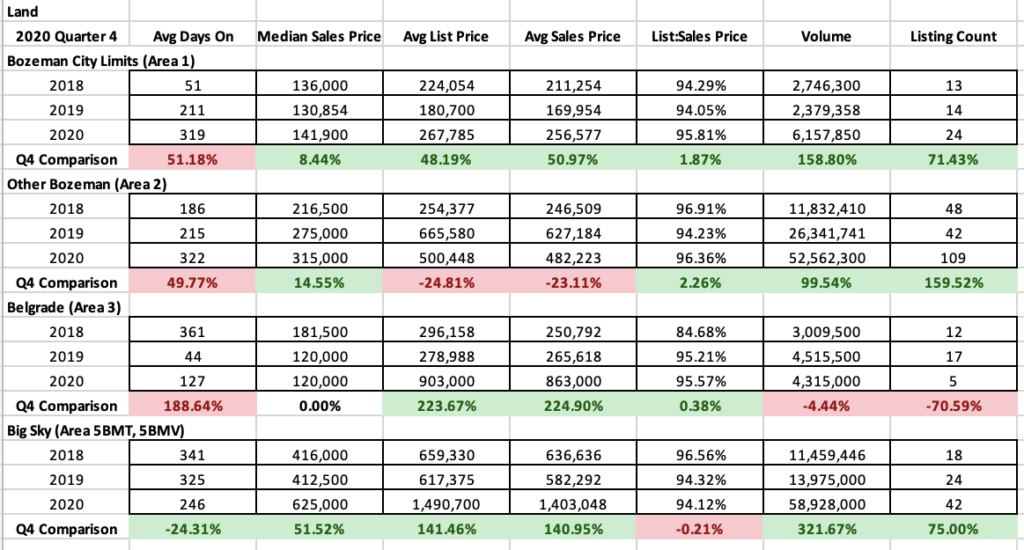

Land

Land sales sparked up in most areas during Q4 2020, only decreasing due to lack of new inventory. Bozeman had a 72% increase year over year as new developments were bought up. Other Bozeman areas shot up 160% as acreage became desirable and Big Sky jumped 75%. Median sales prices accelerated in all areas except Belgrade which was flat due to lack of inventory. Big Sky median jumped an impressive 52% ($625,000). List to sales price ratios tightened in all areas with exception of Big Sky. Discounting of 4-6% is typical on land deals across the board.

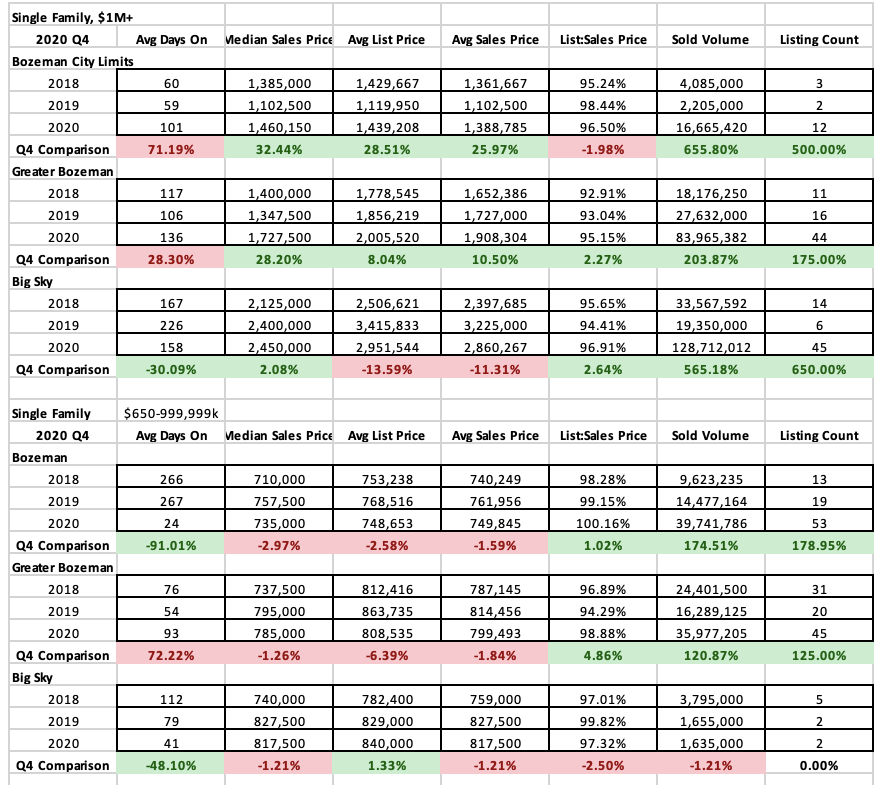

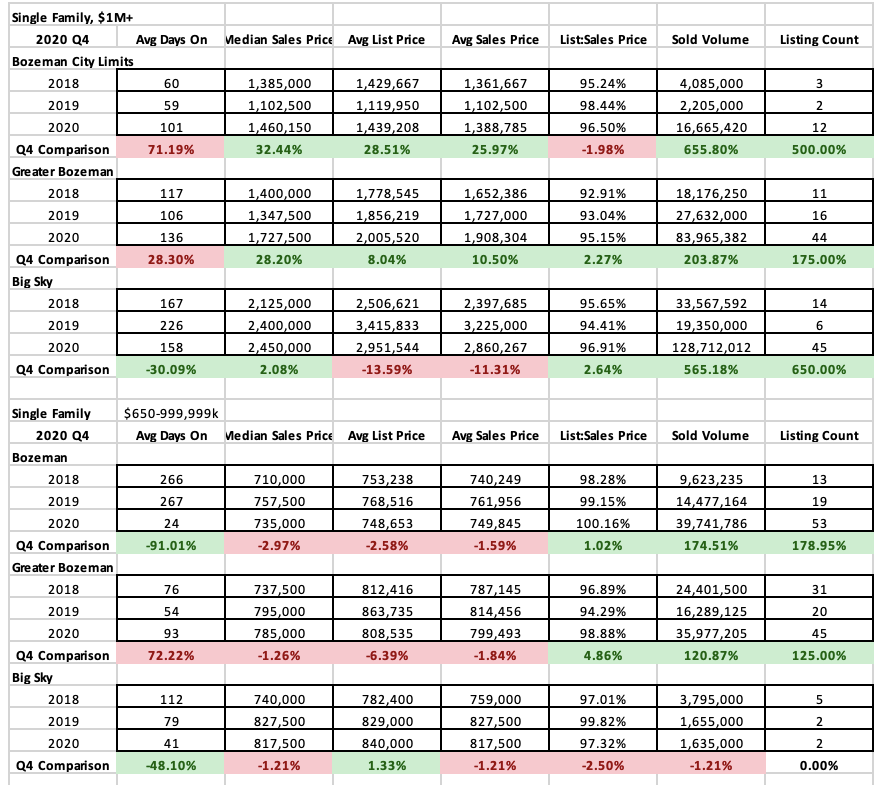

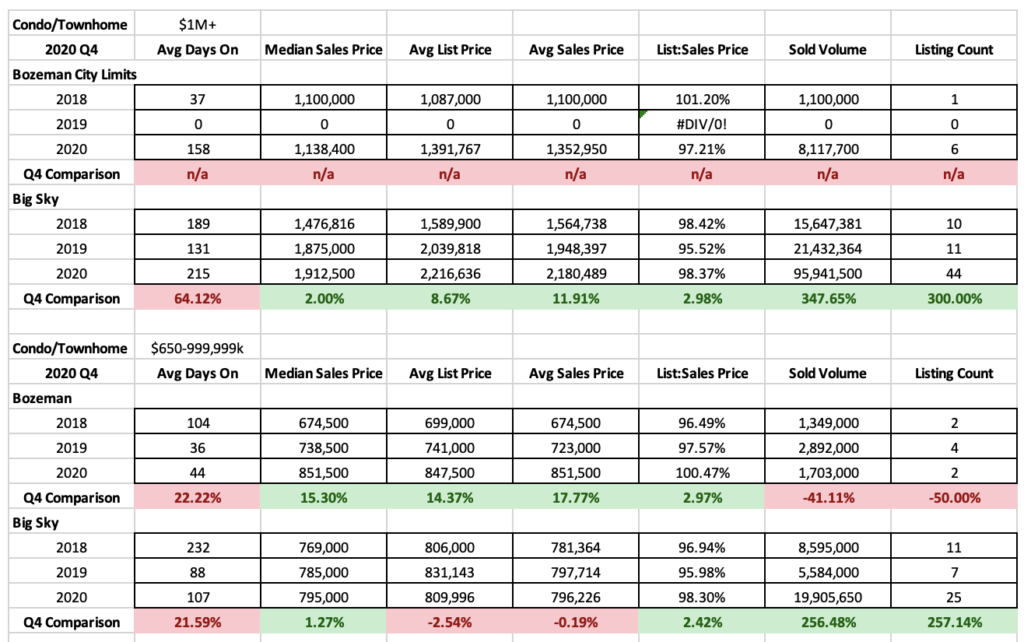

Q4 2020 Y/Y/Y High End and Luxury Analysis

Single Family

This was the single best quarter on record for luxury sales in our area overall. The luxury market accelerated more than any other quarter on record in the areas we track. Properties from $650-$900K saw a 180% increase in sales in Bozeman and a 125% increase in greater Bozeman. Average list to sales price ratios were over 100% in Bozeman indicating prevalent multiple offer scenarios. And discounting of slightly over 1% was average in the greater Bozeman area.

Properties above $1M saw a 500% sales increase jump in City of Bozeman, 175% jump in greater Bozeman and 650% jump in Big Sky. List to sales price ratios show there is still discounting of 4-5% on average of luxury homes. Volumes were up 655% in Bozeman, 203% in greater Bozeman and 565% in Big Sky.

Condos and Townhomes

Luxury condo and townhome sales in the City of Bozeman were up 600% year over year for condos over $1M. Big Sky experienced a 300% increase in sales year over year. New construction inventory has fueled this expansion of the market in both areas with new product in downtown Bozeman, fairly new resale product in downtown Bozeman and tons of new luxury product at Moonlight Basin.

2020 Y/Y/Y Analysis

2020 started off with one of the strongest January and February markets on record as the southwest Montana market was fueled by newcomers. This shifted due to the arrival of Covid-19 in March – the market did not drop but also missed much of the spring appreciation cycle we’d become accustomed to. During stay home orders real estate was considered an essential service – and the market trickled along at 2019 pricing.

Once the visitor 14 day quarantine was lifted on June 1st, a rush of people arrived in our area. These people were eager to stay in Montana, rent and find their next home. This push was fueled by the pandemic, forest fires around the west, civil unrest in cities and the ability for many people to move to working virtually and going to school virtually.

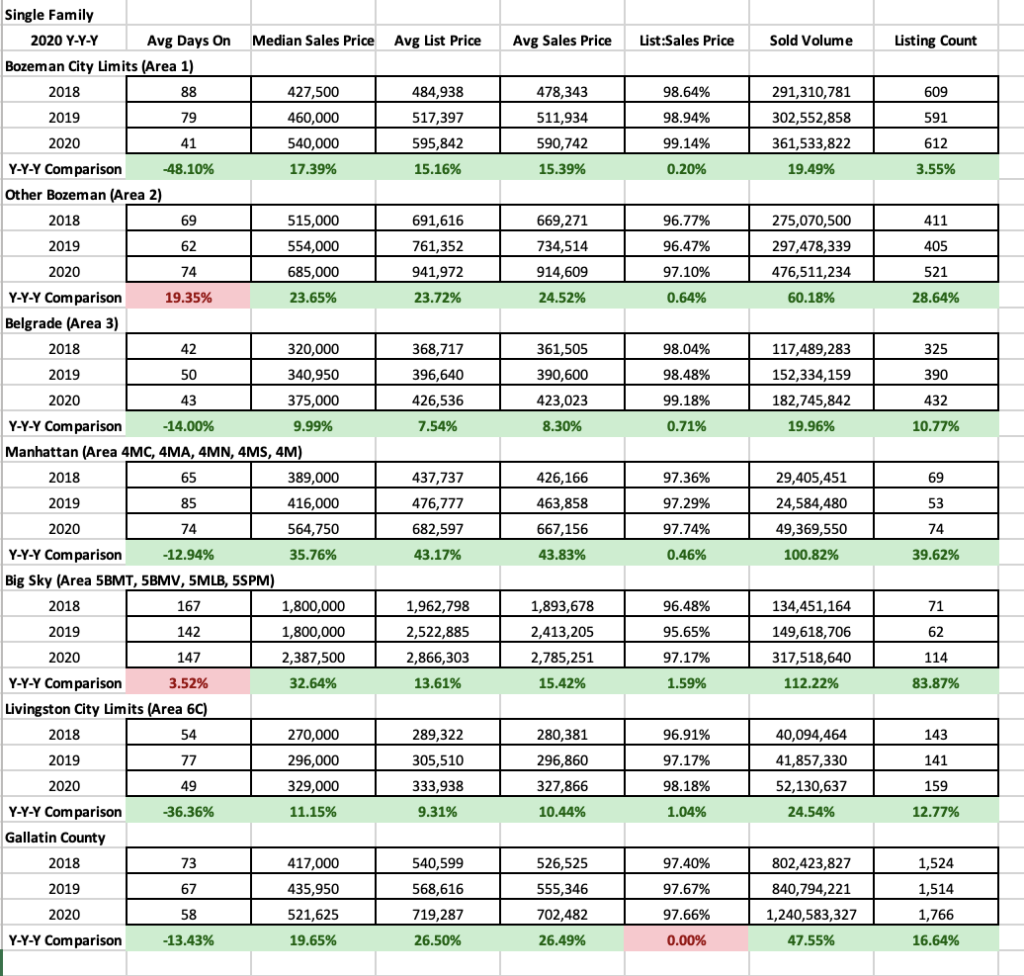

Single Family

The median sales price year over year for single family homes jumped 17% in City of Bozeman ($540,000), 24% in greater Bozeman ($685,000), $10% in Belgrade ($375,000), 36% in Manhattan ($565,000), 33% in Big Sky ($2,387,000) and 11% in Livingston ($329,000).

Listings sold were up 4% year over year in City of Bozeman, 29% in greater Bozeman, 11% in Belgrade, 40% in Manhattan, 83% in Big Sky and 13% in Livingston.

Average days on market reduced in most areas but numbers are skewed due to large shifts of inventory that were stagnant on the market selling during this time.

List to sales price ratios show a reduction in discounting in all areas of the market with discounting less than 1% common in City of Bozeman, Belgrade and Livingston and discounting of less than 3% common in Big Sky, Manhattan and greater Bozeman.

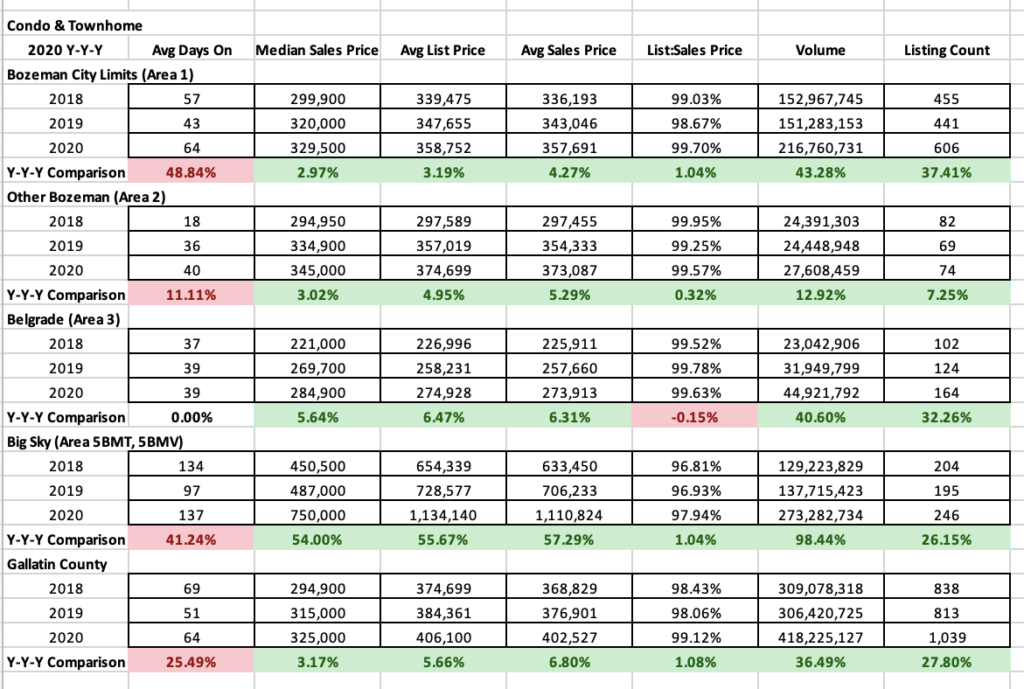

Condos and Townhomes

Condo and townhome median sales prices jumped year over year but not nearly as much as single family homes did. Part of this had to do with price of new inventory available. Median sales prices were up 3% in Bozeman, 3% in greater Bozeman, 6% in Belgrade, 54% in Big Sky. Number of listings sold was where the action was happening – number of units sold were up 37% in Bozeman, 7% in greater Bozeman, 33% in Belgrade and 26% in Big Sky. List to sales price ratios show less than 1% discounting for all areas with exception of Big Sky which saw 2% discounting on average.

Land

Land saw fairly large gains year over year in median sales price. City of Bozeman was up 4%, other Bozeman areas were up 27%, Belgrade was up 14% and Big Sky was up 43%. Number of units sold were up in all areas with exception of Belgrade where new construction lots have pretty much sold out for the time being. Sales were up 46% in City of Bozeman, 75% in greater Bozeman and 27% in Big Sky. List to sales price ratios show discounting hovering around 4-5% in heavily active areas.

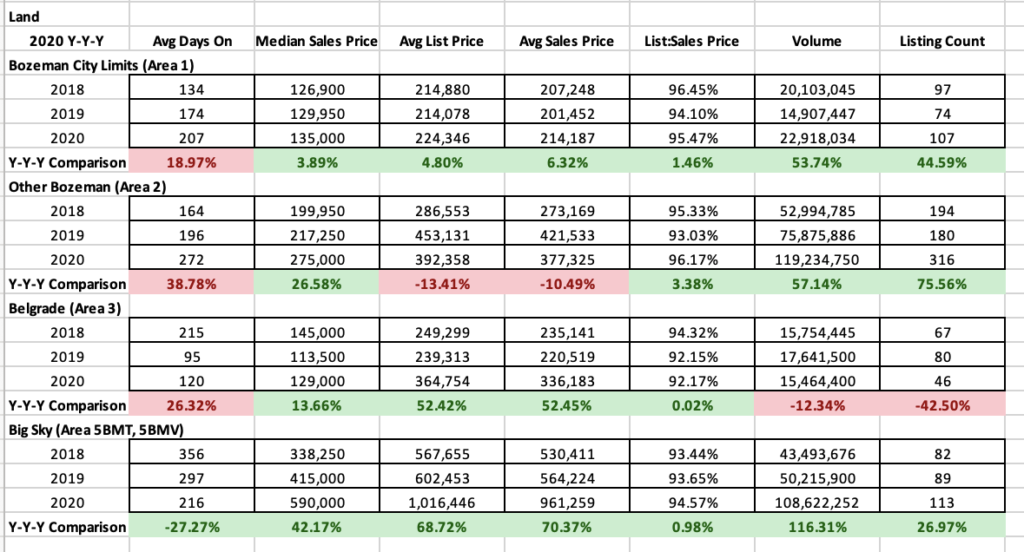

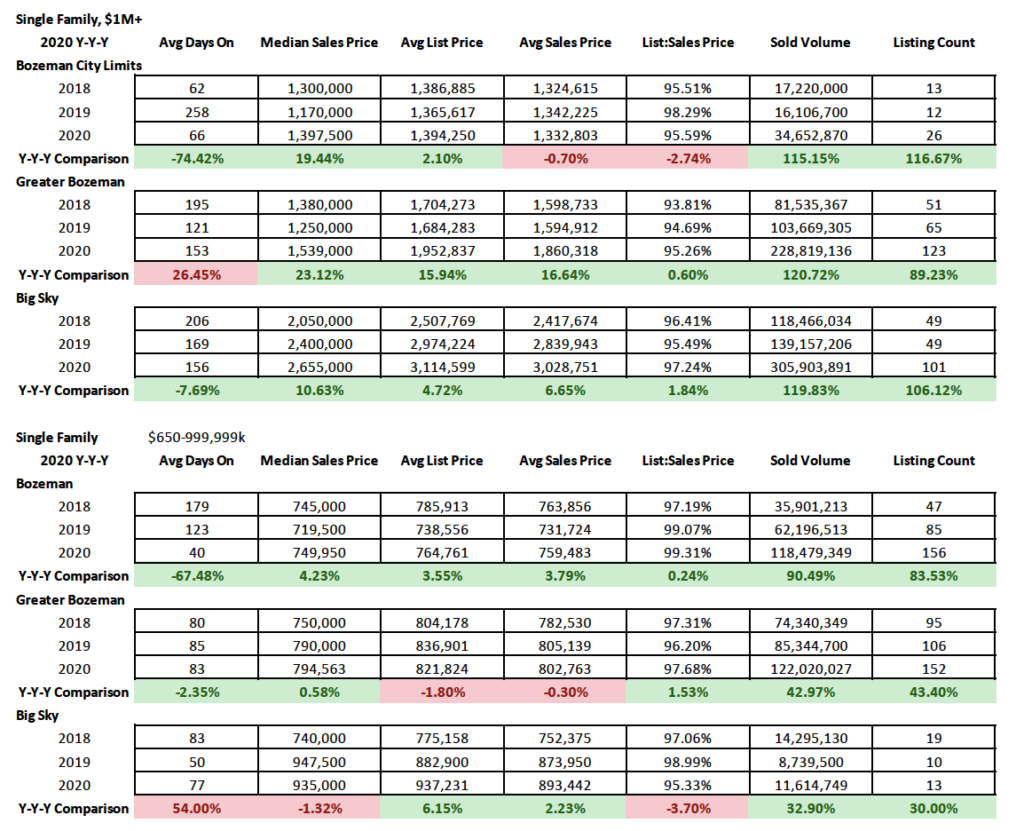

2020 Y/Y/Y High End and Luxury Analysis

2020 was the single largest year for luxury home and condo/townhome sales in southwestern Montana.

Single family homes

Luxury sales were up across the board year over year as new construction inventory and buyer demand fueled the market. Number of listings sold in the $650-$1M segment were up 83% in city of Bozeman, 44% in greater Bozeman and 30% in Big Sky. Number of listings sold in the $1M+ segment were up 117% in City of Bozeman, 90% in greater Bozeman and 106% in Big Sky.

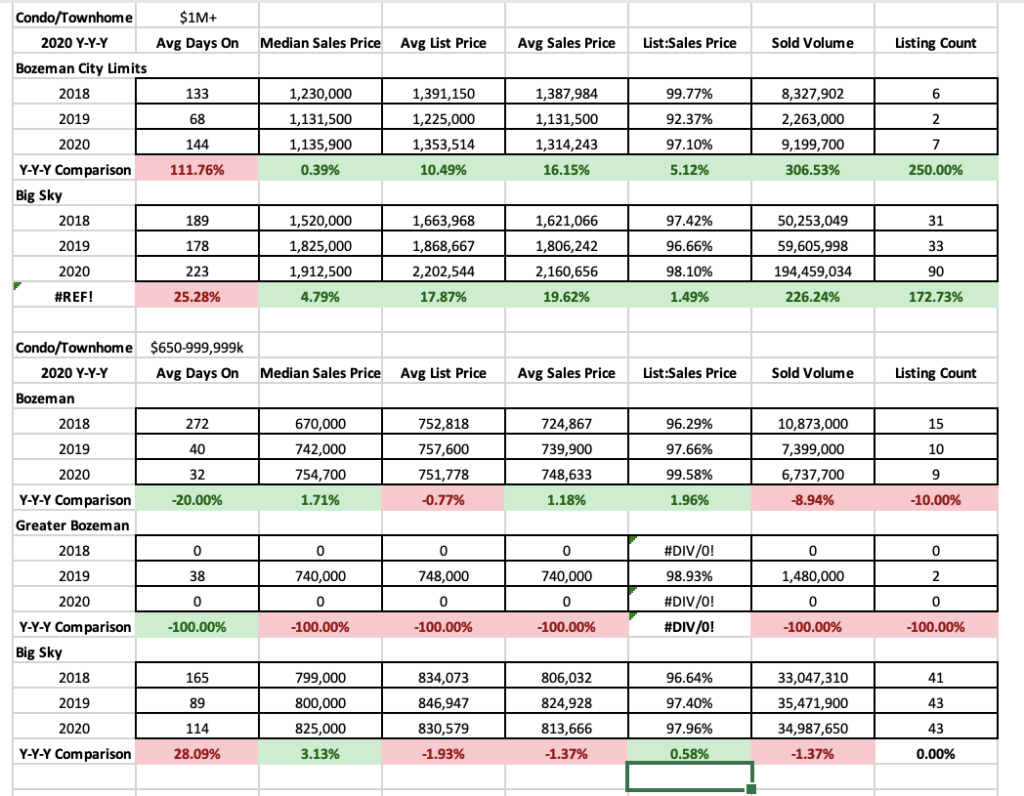

Condos and Townhomes

Condo and townhome sales in the $1M+ luxury segment were up 250% in City of Bozeman and 173% in Big Sky. These numbers were fueled by new construction projects that came to market in 2020 in downtown Bozeman and Moonlight Basin.