The real estate market in the greater Bozeman, Big Sky, and Livingston areas remained steady in Q2 2024 year over year – though inventory has been building across all areas and sectors.

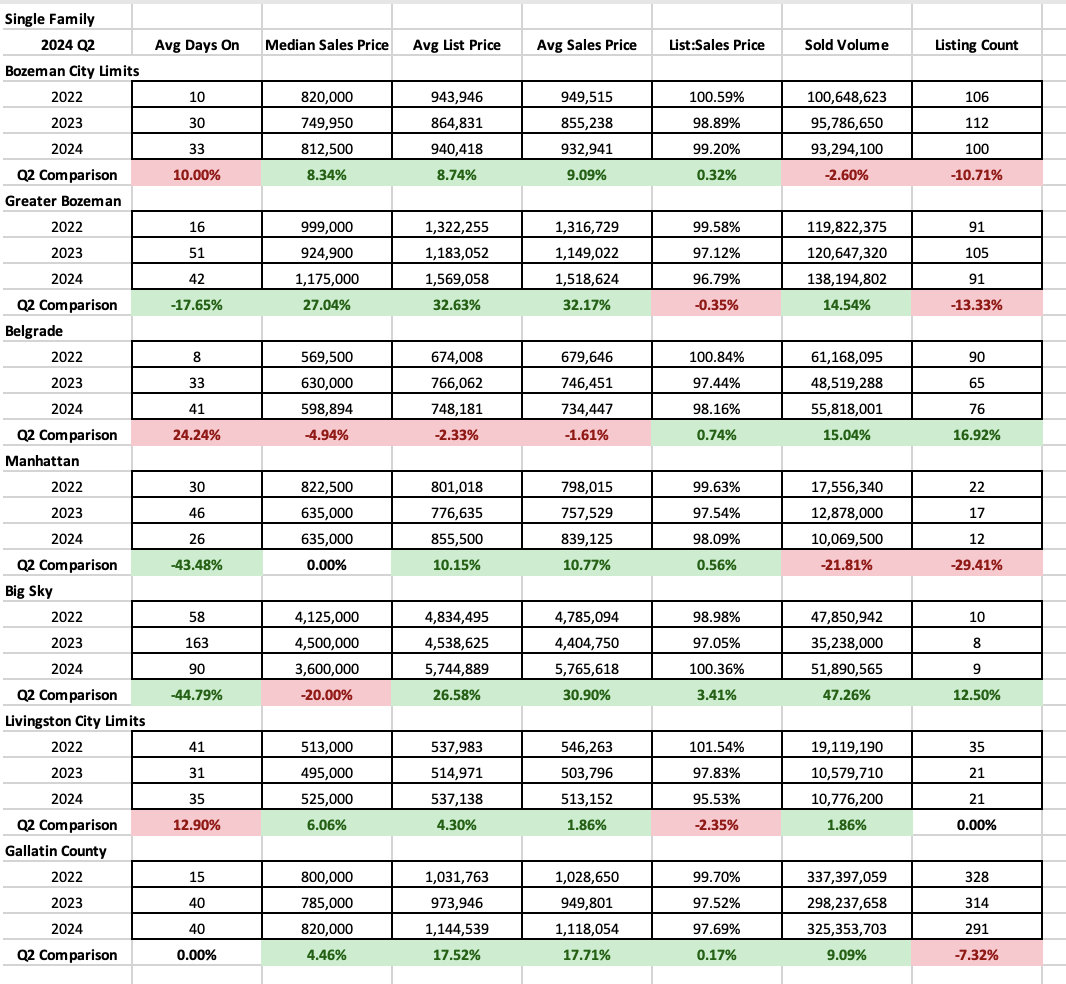

Single Family

Single family median sales prices remained relatively steady overall in Q2 2024 as compared to previous years as inventory is growing across the area. Median sales prices are as follows: City of Bozeman ($812.5K), Greater Bozeman ($1.175M), Manhattan ($635K), Belgrade ($598K), Big Sky ($3.6M), and Livingston ($525K). Number of listings sold is either steady compared to previous years or down slightly. Days on market are also relatively steady year over year – averaging 1-3 months across all areas. List to sales price ratios show less discounting in many areas than last year, in part due to adjusting list prices to fall more in line with buyer expectations. On average properties are being discounted less than 1% in Bozeman City limits off list price, closer to 4% in Greater Bozeman/Livingston, 2% in Belgrade/Manhattan and very little discounting in Big Sky as most of these properties are multi year new construction listings that are finally closing.

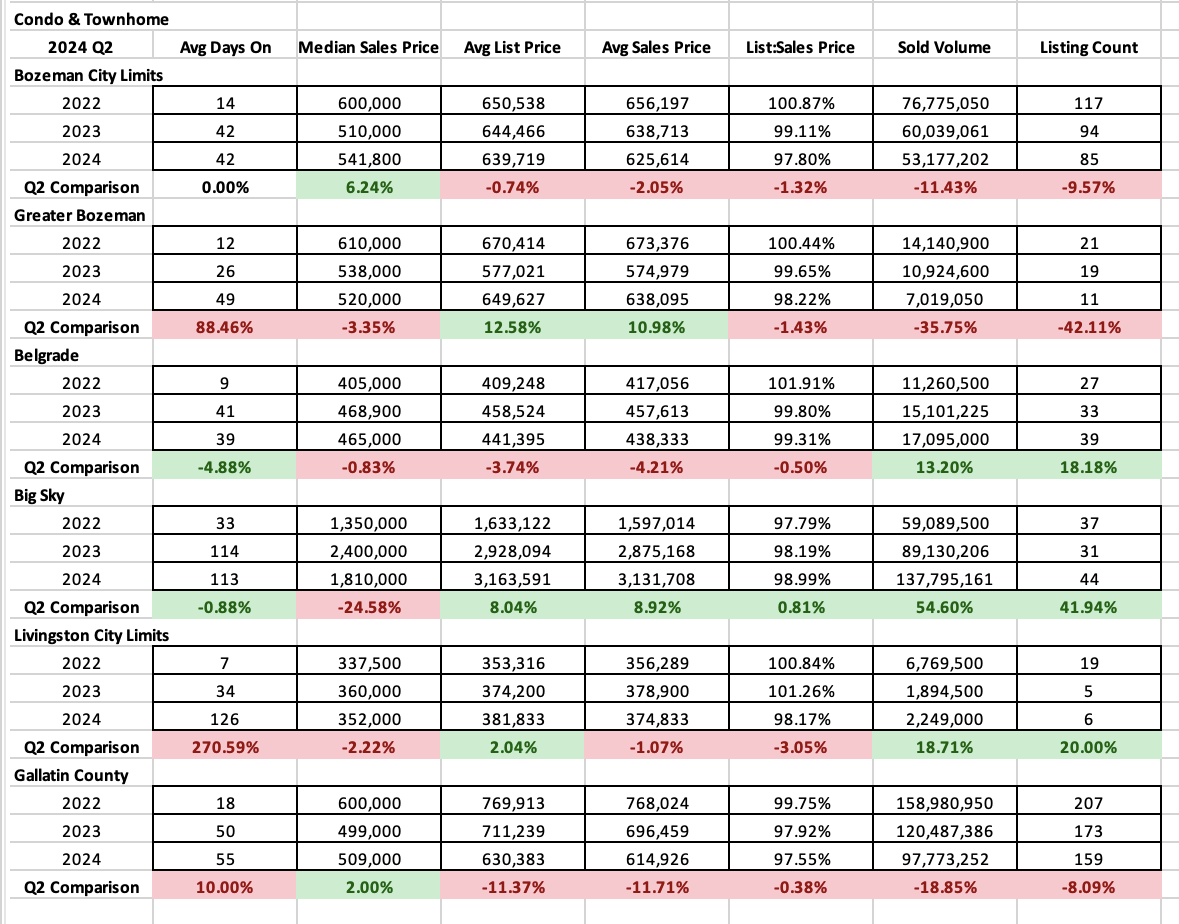

Condo/Townhome

Condo and townhome median sales prices remained relatively steady year over year but prices have softened more than single family homes. Median sales prices are as follows: City of Bozeman ($541K), Greater Bozeman ($520K), Belgrade ($465K), Big Sky ($1.8M), and Livingston ($352K). Number of listings sold were fairly steady with some reduction in City of Bozeman and Greater Bozeman and an increase in Belgrade, Livingston and Big Sky. Days on market were flat in almost all areas with the exception of Greater Bozeman were days on market doubled over 2023. List to sales price ratios continue to show 1-3% discounting in all areas – indicative of a slightly seller tilted market.

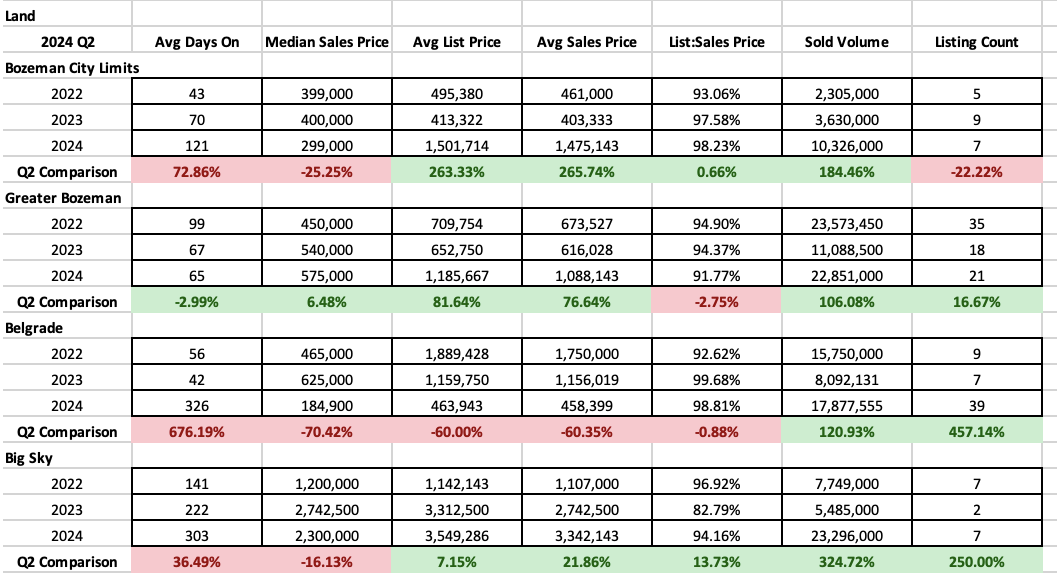

Land

Land sales continue on a steady pace in most areas – the inventory is building and the same number of properties are selling year over year. Median sales prices have dropped significantly in Bozeman, Belgrade and Big Sky – Belgrade in part due to new offerings that have closed in a large new subdivision on the south side of I-90. Number of listings sold is far above average in Belgrade (again the large subdivision sales – next frontier for new construction) and steady in all other areas. Averages days on market have increased in all areas. List to sale price ratios show on average 2% discounting in City of Bozeman and Belgrade, 6% in Big Sky and 8% in Greater Bozeman.

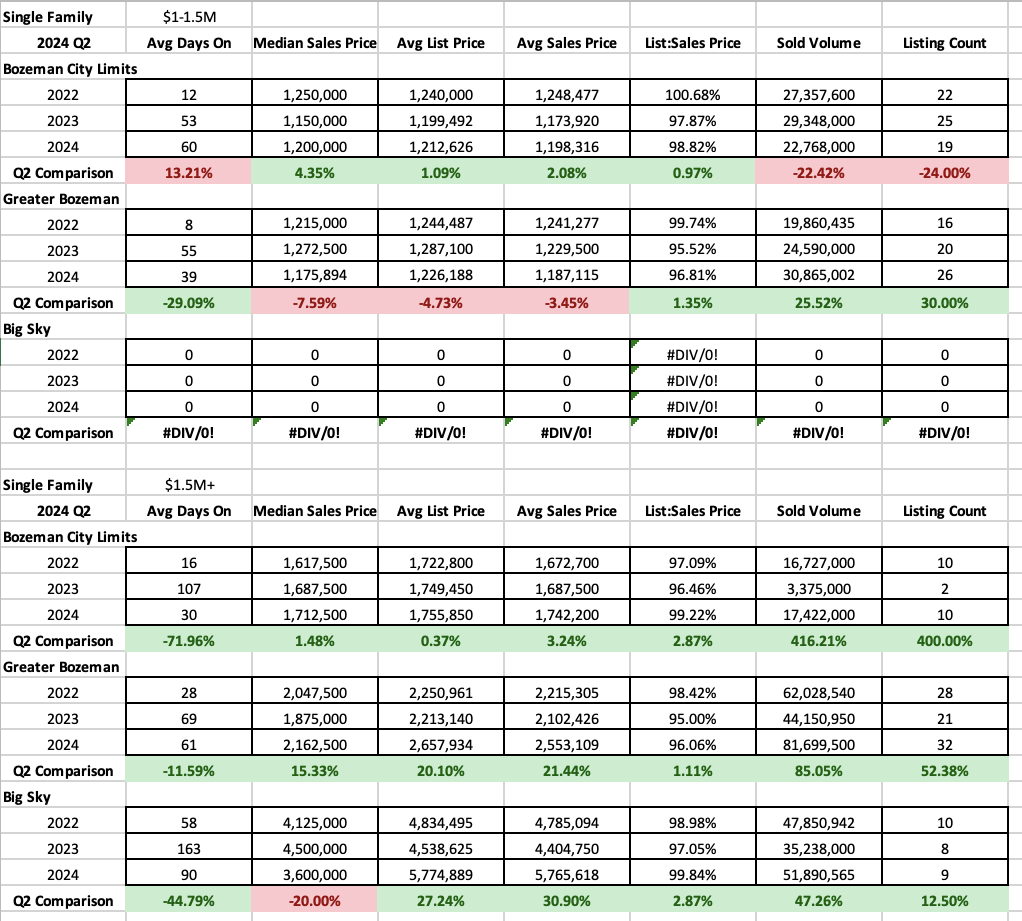

High End and Luxury

Single Family

Single family high-end homes ($1M-$1.5M) in City of Bozeman and Greater Bozeman saw less sales in City of Bozeman and an uptick in Greater Bozeman – offsetting one another. Average days on market increased to 1.5-2 months on average. List to sales price ratios showed 2-3% discounting off list price.

Single family luxury homes ($1.5M+) in City of Bozeman, Greater Bozeman and Big Sky saw an uptick of sales in all areas over Q2 2023. Average days on market were between 1-3 months. List to sales price ratios showed very little discounting in City of Bozeman and Big Sky (less than 1% – in part in Big Sky due to the new construction nature of many sales) and 4% in Greater Bozeman.

Condo/Townhome

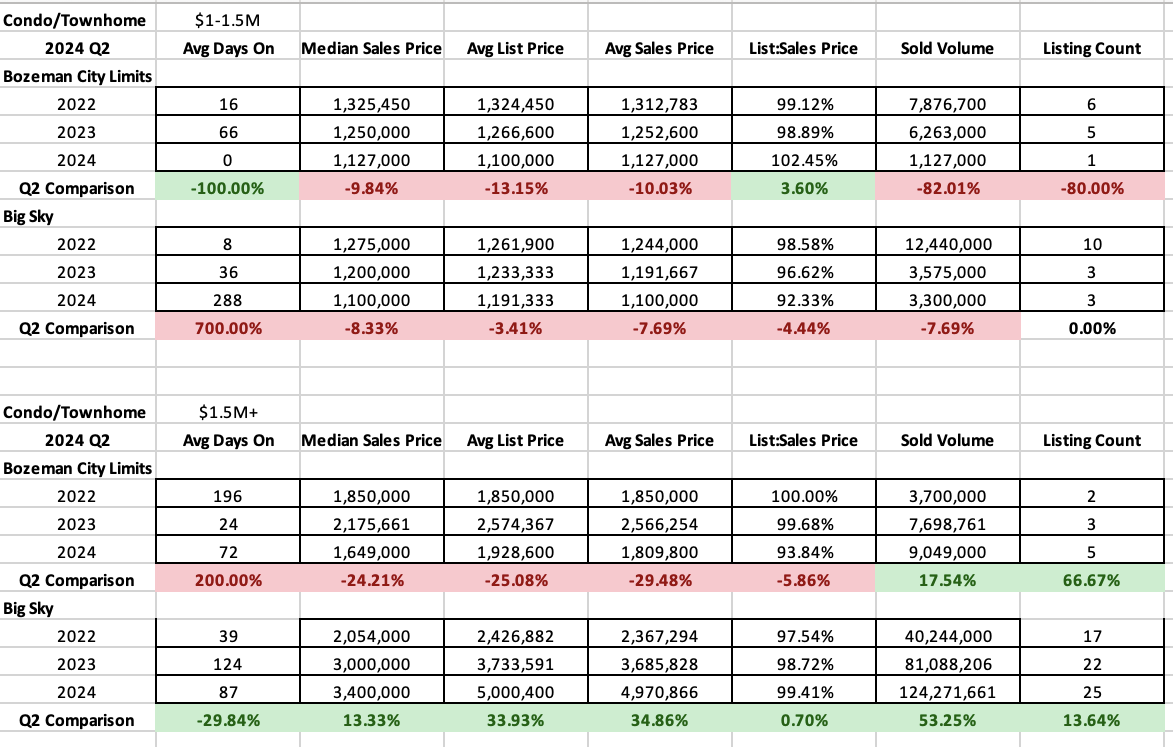

High-end condos and townhomes ($1M-$1.5M) in City of Bozeman and Big Sky showed a big drop in volume for Q2 2024 over Q2 2023 with only 1 sale in City of Bozeman and 3 sales in Big Sky. Average days on market were up significantly in Big Sky. Big Sky saw a list to sales price ratio discounting of 7% off original list price.

Luxury condos and townhomes ($1.5M+) saw an uptick in sales in both City of Bozeman (5) and Big Sky (25) in Q2 2024. Average days on market were 2-3 months for both areas. List to sales price ratios showed discounting of around 6% in City of Bozeman and less than 1% in Big Sky (new construction continues to dominate Big Sky sales).