Year Over Year 2024 Real Estate Market Analysis & Statistics

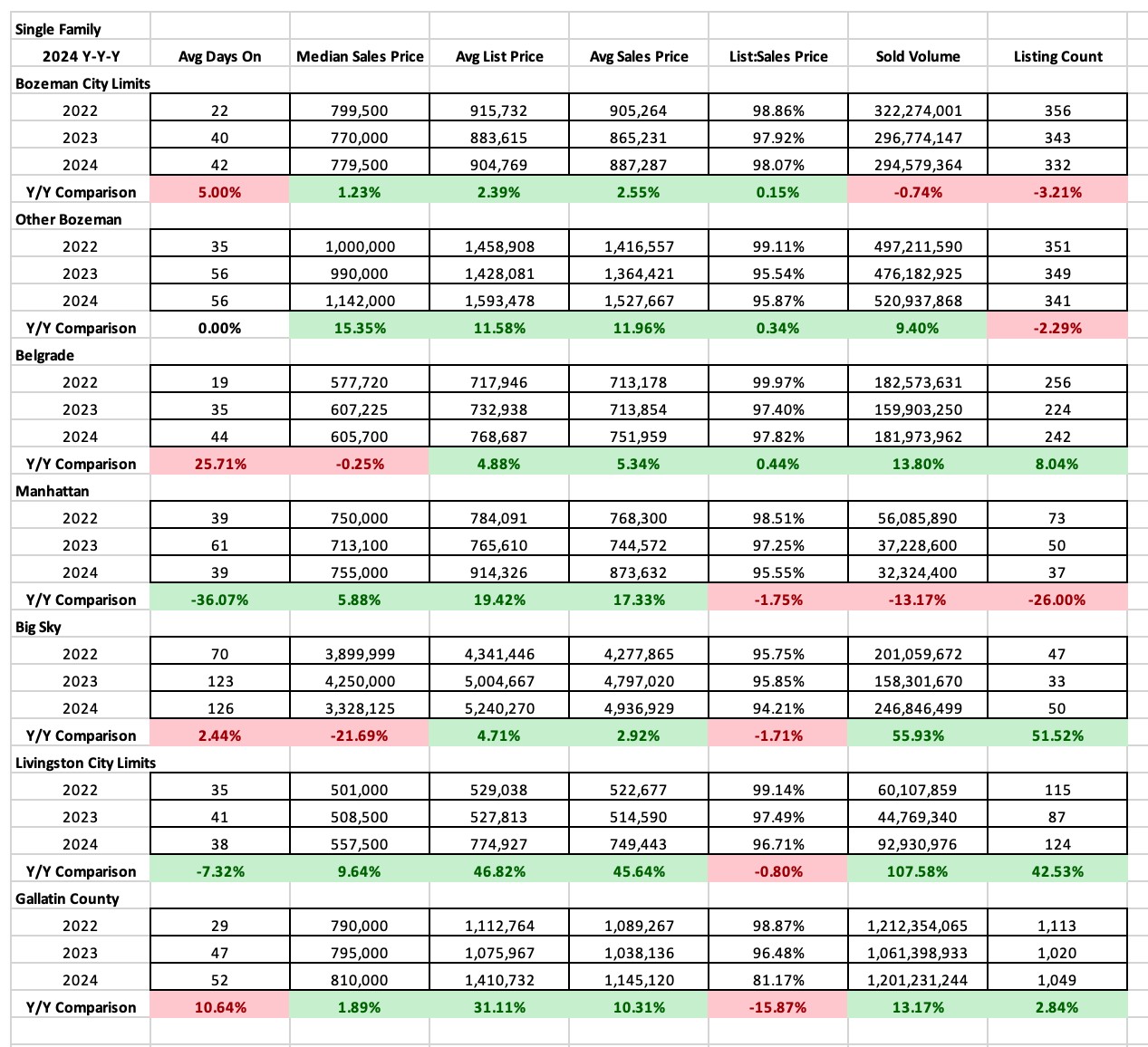

Single Family

Comparing year over year 2024 to 2023 and then again to 2022, median sales prices for single family homes have remained either static or have experienced modest appreciation over 2023 and when compared to 2022, values have stayed relatively flat or in some cases, dropped. Single family median sales price for City of Bozeman ($779,000), Belgrade ($605,700), and Manhattan ($755,000) were relatively flat over 2023 and 2022 pricing. Greater Bozeman outside city limits ($1,142,000) ticked up slightly – positing a 15% gain over 2023 and a 14% gain over 2022. Big Sky ($3,328,000) slumped 22% from 2023 – possibly due to the volume of higher end new construction homes that pended during the pandemic that sold in 2023 – pricing is down in 2024 closer to 15% over 2022 which is still considered peak of the pandemic market.

Number of units sold in 2024 were steady in most areas – falling in line with 2022 sales more than 2023 sales – likely due to buyers becoming more accepting of the rate climate and sellers willing to negotiate on pricing a bit more. Number of listings sold were flat in City of Bozeman, were flat in greater Bozeman, were flat in Belgrade, were down slightly in Manhattan, were up to 2022 levels in Big Sky and Livingston.

List to sales price ratios show that there has been discounting – though it hasn’t risen significantly year over year – in all areas of the market between list price and sales price – but discounting is nominal – it’s indicative of a balanced market. Discounting in City of Bozeman was 2%, greater Bozeman 3.1%, Belgrade 2.2%, Manhattan 4.5%, Big Sky 6.8%, and Livingston 3.3%.

Average days on market year over year stayed relatively flat throughout the area, with some modest increases. Time on market averaged just over 1 month in Bozeman, almost 2 months in Greater Bozeman, 1.5 months in Belgrade, just over a month in Manhattan, 4 months in Big Sky, and just over a month in Livingston.

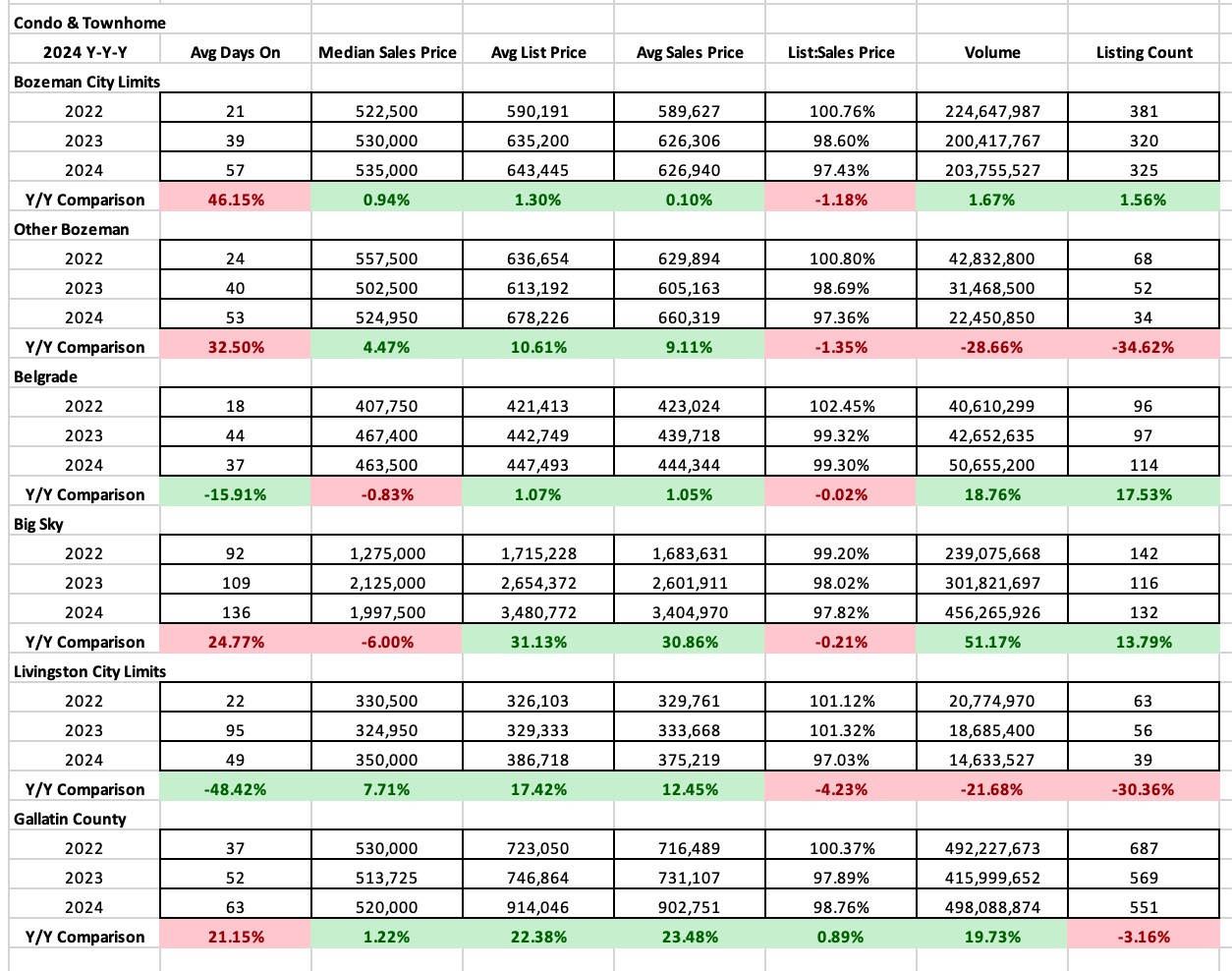

Condo/Townhomes

Condo and townhome median sale prices have stayed strong, with little price appreciation but also little value deflation. City of Bozeman ($535,000), Greater Bozeman ($525,000) and Belgrade ($463,500) are all flat year over year. Big Sky ($1,997,500) dropped slightly at 6% below 2023 median sale price. Livingston ($350,000) grew slightly due to increasing new construction condo product.

Number of units sold in 2024 were steady in most areas and declined in others – mostly due to lack of new construction inventory in those areas. It was flat in City of Bozeman year over year, grew in Belgrade due to new construction offerings, grew in Big Sky due to new construction offerings and declined in greater Bozeman and Livingston.

List to sales price ratios show continued modest discounting in all areas – indicative of a seller’s market in some areas and a balanced market in others. Discounting in City of Bozeman was 2.5%, in greater Bozeman 2.7%, in Belgrade 0.7%, in Big Sky 2.2% and in Livingston 3%.

Average days on market crept up in all areas with the exception of Belgrade and Livingston. It’s just under 2 months in Bozeman, just under 2 months in greater Bozeman, just over 1 month in Belgrade, 4.5 months in Big Sky and 1.5 months in Livingston.

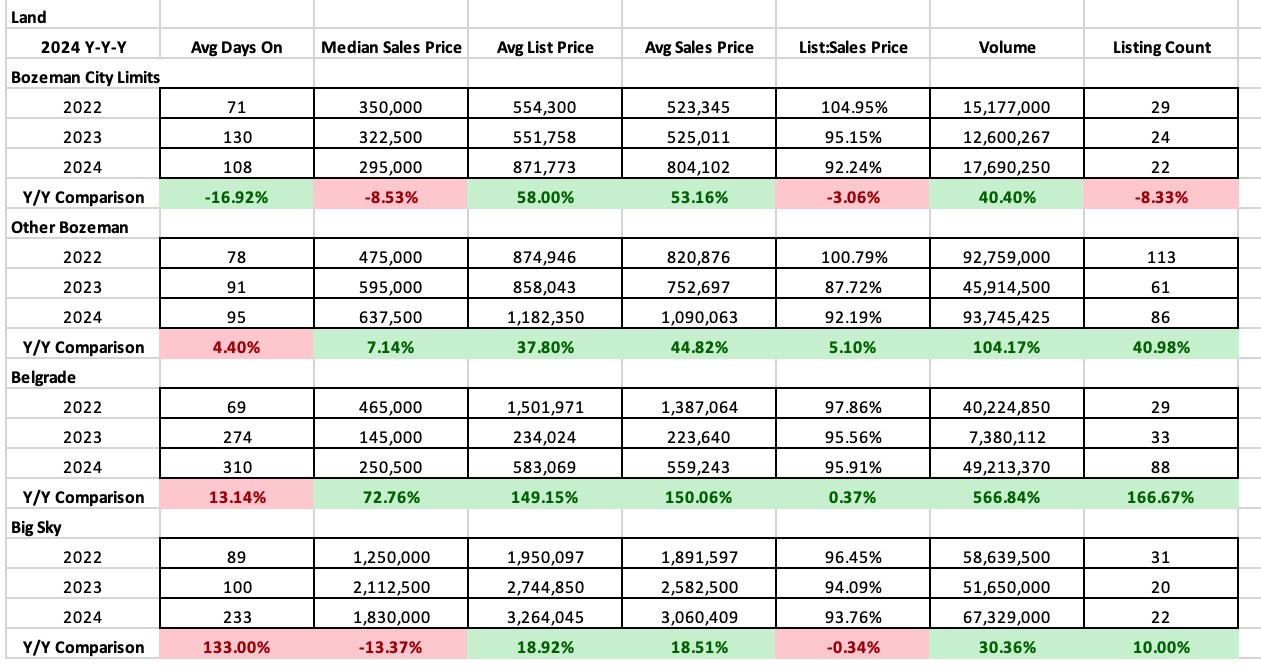

Land

Land continued to stay relatively robust value wise and some areas showed an uptick over 2023. Median sales price in City of Bozeman ($295,000) dipped as did median sales price in Big Sky ($1,830,000). Median sales price in greater Bozeman ($637,500) jumped slightly and City of Belgrade ($250,000) appreciated more quickly due to multi-family lots selling in new construction neighborhoods.

Total number of listings sold were steady overall, flat in City of Bozeman and Big Sky year over year, up ticked slightly in greater Bozeman and jumped significantly in Belgrade due to new construction offerings.

Averages days on market crept up in most areas with the exception of City of Bozeman. Days on market averaged just over 3 months in City of Bozeman, 3 months in greater Bozeman, 10 months in Belgrade and 8 months in Big Sky.

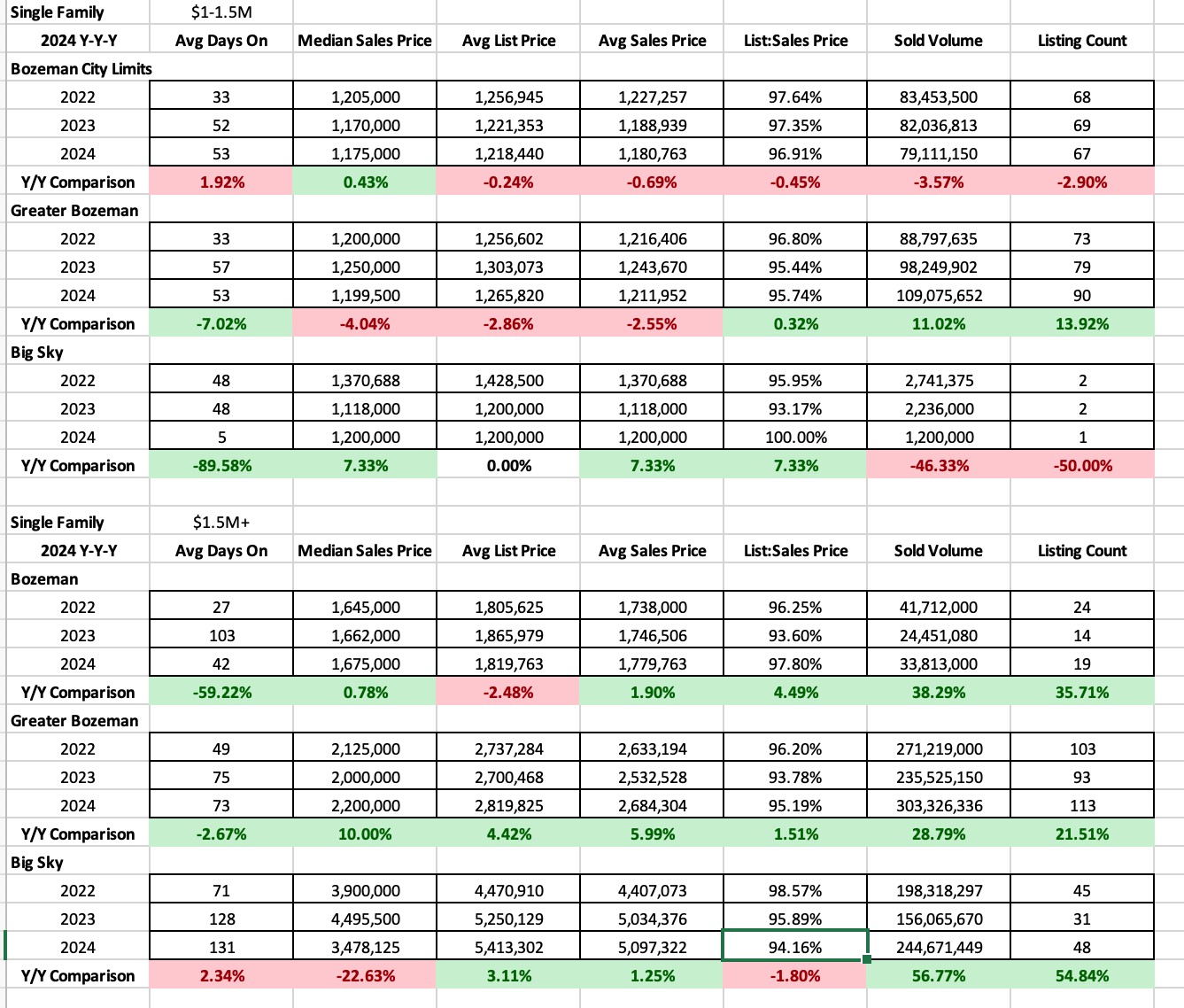

High-End and Luxury

Single Family

High-end single-family home number of sold listings (those $1M-$1.5M in closed price) in the three areas tracked (City of Bozeman, greater Bozeman, Big Sky) showed steady sales – greater Bozeman ticked up over 2022 and 2023 number of listings sold. Big Sky has had only one sale in this price point this year. List to sales price ratios show there was some discounting happening but not much between list price and sales price – in City of Bozeman discounting tallied at 3.1% and greater Bozeman 4.25% – this is indicative of a balanced market. Days on market were flat in City of Bozeman and greater Bozeman year over year – averaging around 2 months.

Luxury single family home number of sold listings (those $1.5M and higher in closed price) in the three areas tracked (City of Bozeman, greater Bozeman and Big Sky) showed continued strength of number of listings sold – all numbers were significantly higher than 2023 and were on par with 2022. List to sales price ratios shows some discounting – 2.2% on average in City of Bozeman, 4.8% in greater Bozeman and 6.85% in Big Sky. These indicate either a balanced or slightly buyer leaning market. Days on market stayed flat or dropped slightly in all areas – on average 2 months in City of Bozeman, 2.5 months in greater Bozeman and 4.5 months in Big Sky.

Condo/Townhomes

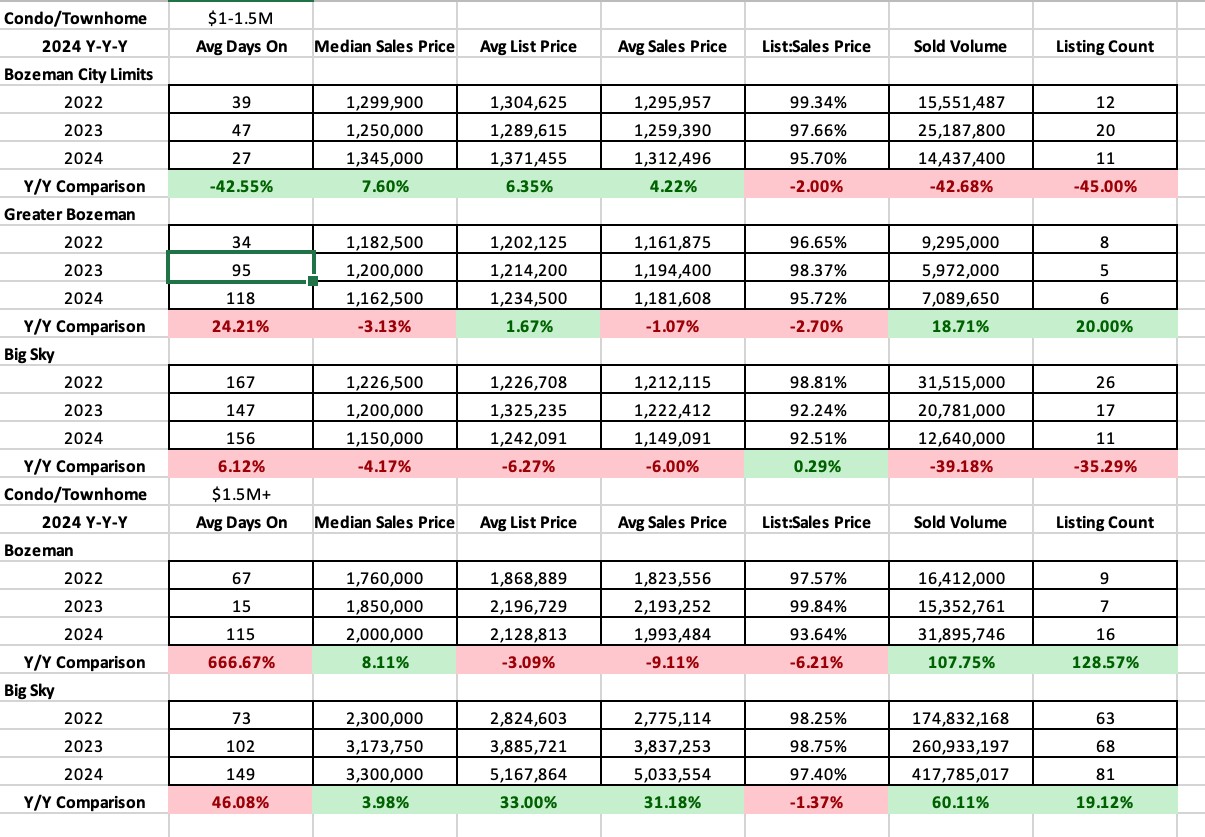

High-end condo and townhome number of sold listings (those $1M-$1.5M in closed price) in the three areas tracked (City of Bozeman, greater Bozeman and Big Sky showed reduced number of sales in City of Bozeman and Big Sky – on par with sales in 2022 in Bozeman – and steady sales in greater Bozeman. List to sales price ratios showed discounting in all areas, with 4.3% on average in City of Bozeman, 4.3% in greater Bozeman and 7.5% in Big Sky. Days on market showed a drop in city of Bozeman – down to 1 month – and an uptick in greater Bozeman – averaging 4 months and Big Sky was flat at 6 months.

Luxury condo and townhome number of sold listings (those $1.5M and higher in closed price) in the two areas tracked (Bozeman, Big Sky) showed steady listing closings – doubling in City of Bozeman and up 20% in Big Sky – a function of new construction offerings closing. Days on market had an uptick in City of Bozeman to 4 months and Big Sky also increased to 5 months.